Renters Insurance in and around Los Angeles

Los Angeles renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

There’s No Place Like Home

Your belongings are important and so is keeping them safe. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your TV to your golf clubs. Not sure how much insurance you need? That's alright! Carmel Stevens is here to help you evaluate your risks and help secure your belongings today.

Los Angeles renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Open The Door To Renters Insurance With State Farm

Renting a home makes the most sense for a lot of people, and so is getting insurance to protect your belongings. In general, your landlord's insurance could cover the cost of damage to the structure of your rented home, but that doesn't cover the things you own. Renters insurance helps safeguard your personal possessions in case of the unexpected.

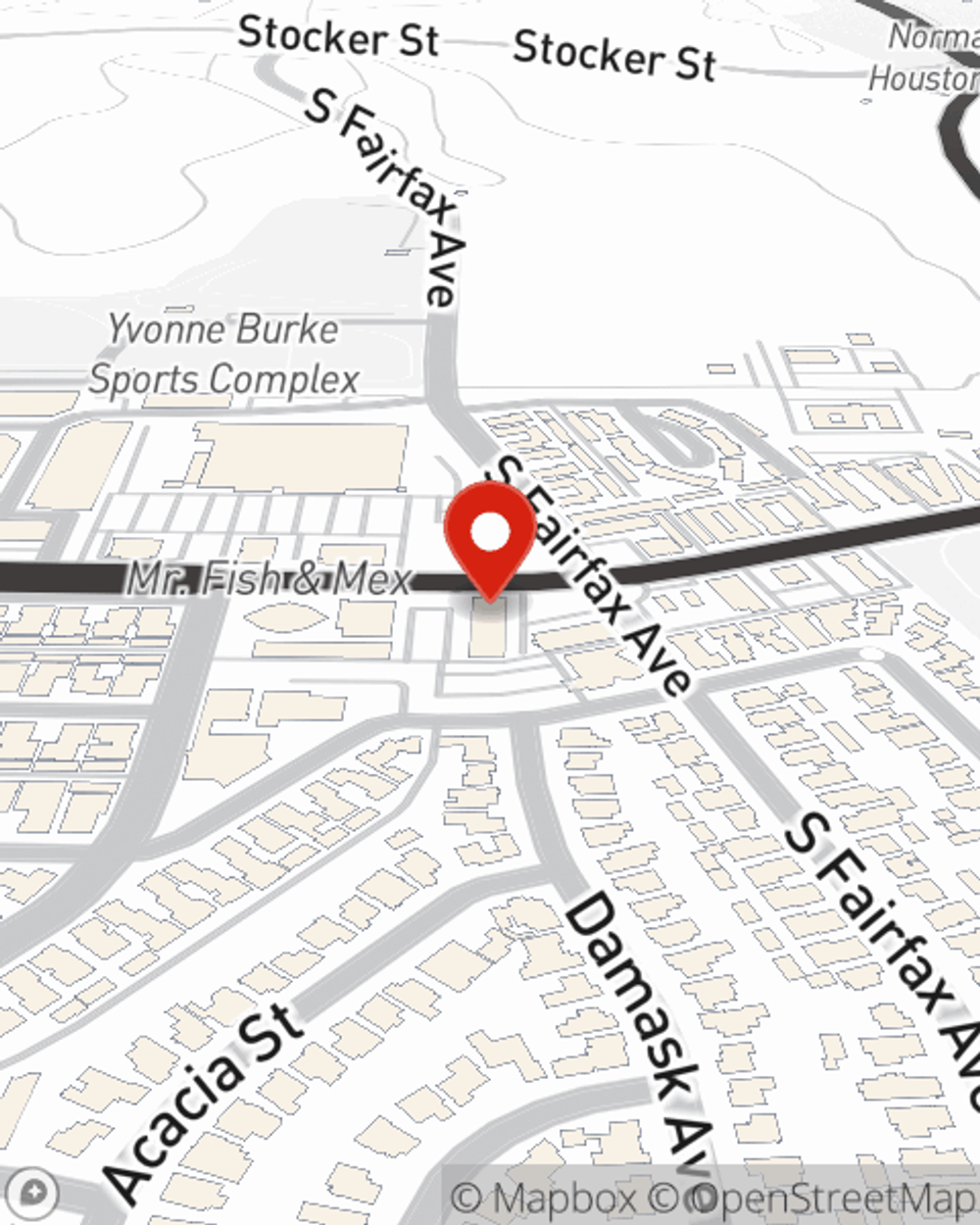

There's no better time than the present! Visit Carmel Stevens's office today to discuss your coverage options.

Have More Questions About Renters Insurance?

Call Carmel at (323) 292-7930 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Carmel Stevens

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.